What is a ‘Bitcoin Treasury’ and who has the most Bitcoin?

There’s no denying that Bitcoin has transitioned from a niche digital asset to a significant component of both national and corporate treasuries over the last few years.

But what exactly is a ‘Bitcoin Treasury’, who owns the most Bitcoin and just what is happening here?

These are all great questions, so let’s dive in and make some sense of it all.

What is a ‘Bitcoin Treasury’ anyway?

Refreshingly, this is one of those things that’s as simple as it sounds! Many companies — especially ones with large cash reserves – choose to invest their money into various different financial instruments rather than leave it in cash. The reasons for this are usually based around increasing the value of their balance sheet over time, generating extra revenue, or simply protecting against the consistent loss of cash value due to inflation.

Traditionally, the chosen assets have been bonds, precious metals, real-estate or investment funds but, in recent years, certain companies have increasingly held Bitcoin as part of those reserves.

And it’s easy to see why. Bitcoin has returned an average CAGR (Compound Annual Growth Rate) of around 80% over the last decade, is extremely liquid and relatively easy to hold — all of which make it an ideal treasury solution.

But Bitcoin has also yielded some additional, perhaps unexpected, benefits for companies who have moved to include it on their balance sheets. In almost every case, it has provably increased market visibility, reinforced an innovative corporate image, and positively driven stock performance. The value of the PR alone can be extremely beneficial to any company, even over and above the long term returns of holding the asset.

So, who are the largest Bitcoin holders to date, and what do the latest trends tell us about what will happen next?

Who owns the most Bitcoin?

Since August 2020, corporate adoption of Bitcoin has surged dramatically. It was that month that Strategy (formerly Microstrategy) announced it had successfully added 21,454 Bitcoin to its balance sheet using $250 million of its cash reserves. This was significant because Strategy was a large, well-established and publicly traded company, and they had managed to do something that was considered close to impossible to do at the time.

It marked a complete pivot of their strategic focus going forward, with the company now describing its core business as a ‘Bitcoin Treasury company’. Today, it holds 528,185 Bitcoin (or 2.5% of the entire global supply) and intends to continue acquiring it until further notice. The company’s market cap has skyrocketed from $1.4 billion to around $76 billion by April 2025 as a result — an increase of over 5,300% over the period.

Unusually, Strategy not only made their playbook public, they actively helped other companies looking to do the same, and this kick-started a whole host of household names adding Bitcoin to their balance sheets. By September 2024, businesses held approximately 683,332 BTC, representing about 3.3% of Bitcoin’s total supply—a 587% increase since summer 2020. That number has increased still further since then.

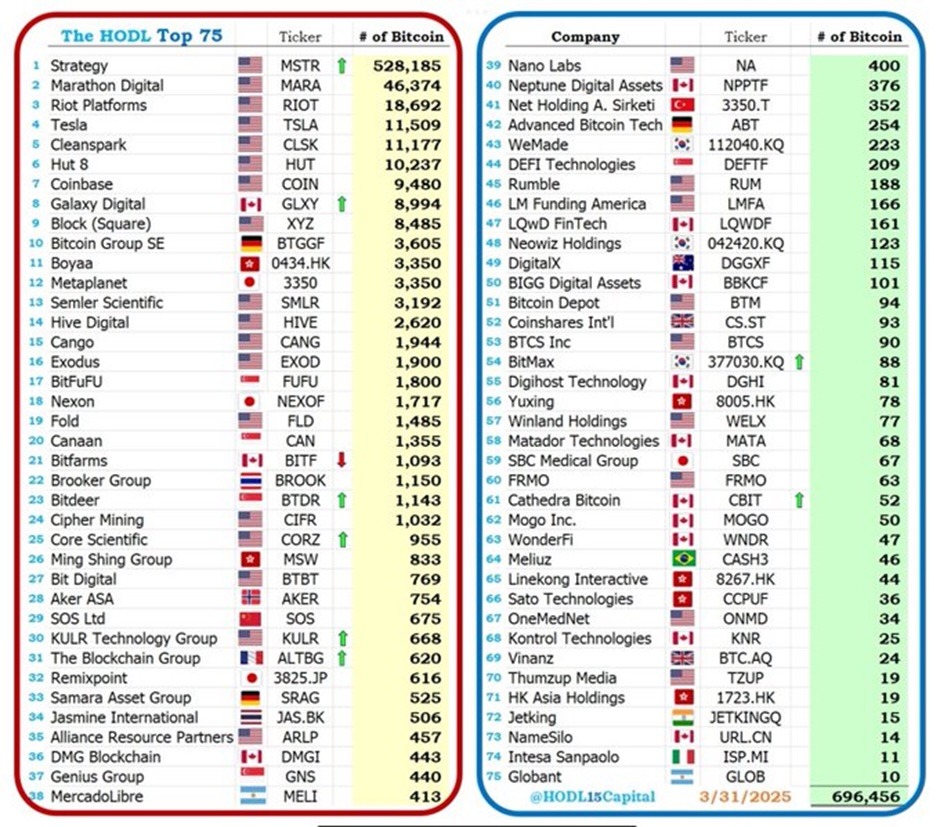

Since publicly traded companies are required to reveal their holdings, it is relatively simple to keep tabs on who owns what and who is still acquiring. As of 31st March, the top 75 chart of global companies holding Bitcoin on their balance sheets looks like this:

Image: data collated by HODL15Capital on 31/3/25

This, of course, is a snapshot and the numbers change constantly, but it’s also interesting to note that once a company moves to add Bitcoin to its balance sheet, it almost never sells it again. In fact, almost all continue to acquire more Bitcoin, often issuing stock or debt to do so. As a result, just these 75 companies alone have now removed around 3.3% of the global supply from circulation — probably forever – and this number is growing daily.

It’s also worth mentioning that this list includes only publicly traded companies. It is known that there are literally hundreds, if not thousands, of private companies ranging from tiny to very large, who have also made it clear that they have added ‘some’ Bitcoin to their balance sheets without necessarily revealing amounts. Some have used it as more than a simple treasury asset, leveraging it in the same way as any other asset to expand and develop into new markets.

Overall, the trend is undeniable and, given that Bitcoin’s supply is strictly limited to 21,000,000, it will become increasingly difficult for companies to acquire it in the years to come.

The race is on!

Expert Predictions for Bitcoin Treasuries

Looking ahead, most experts anticipate continued growth in Bitcoin adoption in corporations.

Apart from now being a proven strategic benefit, it’s also getting easier to actually do. In the US, for example, the recent update of the Financial Accounting Standards Board (FASB) allowing companies to recognize Bitcoin at fair value is likely to have a positive impact. Many other countries are also working on clarification of legislation to make the process of managing and accounting for Bitcoin on balance sheets easier and more transparent.

Even so, how is this done? Where do you even start, especially if you’re new to Bitcoin?

Well, that’s where BTC Prague Business Day comes in!

BTC Prague: Building bridges

The marked increase in interest levels of corporations looking to work with Bitcoin is a key factor in the reimagining of what was previously known as ‘Industry Day’ into a new look ‘Business Day’ for BTC Prague 2025.

Designed for decision-makers, entrepreneurs, and C-suite executives seeking to understand and implement Bitcoin strategies effectively, this dedicated day is set aside to answer these – and many other – questions.

With carefully curated content, enhanced networking opportunities and multiple specialist panels and side events, it’s fast shaping up to be the ultimate event for beginning the process of adding Bitcoin to your company’s balance sheet. Here, you’ll be able to learn directly from the people who have done it successfully, including Michael Saylor himself, the man behind Strategy’s pivot to a Bitcoin Treasury Company!

If you’re ready to start exploring Bitcoin as a possible corporate treasury asset and evaluate the opportunities it provides, then this event is for you! Click here for more details and how to get tickets!