Why European Executives Can No Longer Ignore Bitcoin: A Corporate Perspective

In 2024, Bitcoin solidified its position as a fundamental pillar of the evolving financial ecosystem. Institutional adoption, regulatory clarity, and technological advancements have transformed Bitcoin from a speculative asset to a strategic treasury asset for corporations worldwide. If you’re a European executive still on the sidelines, now is the time to assess Bitcoin’s role in your corporate strategy. In their “Big Ideas 2025” report, ARK Invest identifies a number of important developments.

Bitcoin’s Institutional Breakthrough

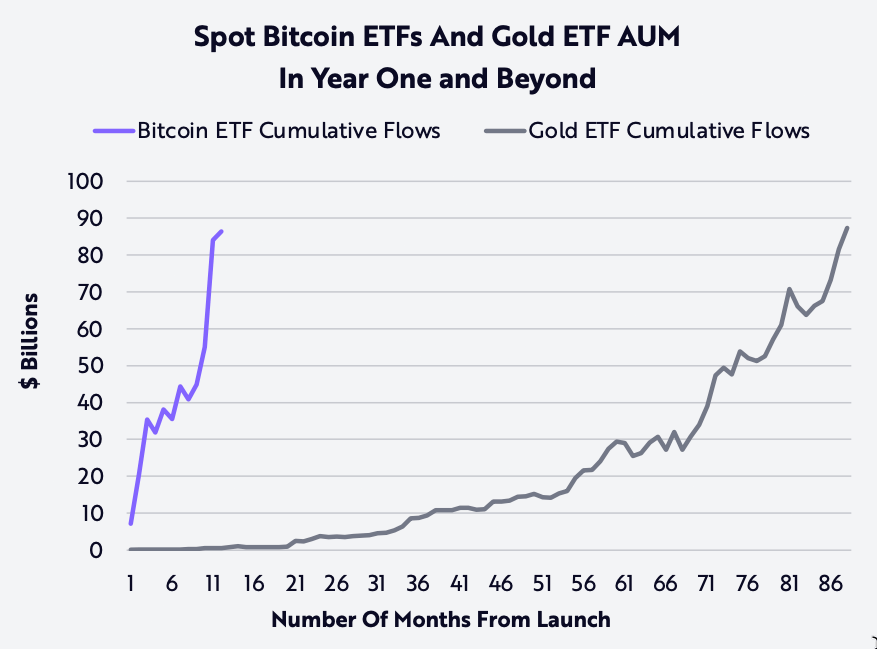

The launch of Spot Bitcoin ETFs in the U.S. was the most successful ETF launch in history, attracting over $4 billion in inflows on day one. For context, this dwarfs the $1.2 billion that flowed into the first-month launch of the Gold ETF in 2004. The ability for institutions to gain Bitcoin exposure through a regulated financial product marks a paradigm shift in adoption.

(source: ARK Invest)

European businesses can leverage these ETFs for treasury management and portfolio diversification. More critically, the potential introduction of similar ETFs in European markets could enable regional corporations to adopt Bitcoin with reduced risk and increased liquidity.

Bitcoin’s Role as a Corporate Treasury Asset

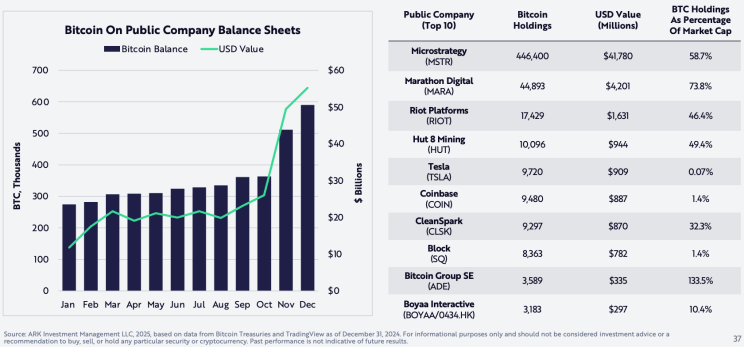

A growing number of publicly traded companies are now holding Bitcoin as a hedge against currency devaluation and inflation. Companies like MicroStrategy, Marathon Digital, and Tesla have made significant Bitcoin acquisitions, with total corporate holdings increasing fivefold from $11 billion in 2023 to $55 billion in 2024.

(source: ARK Invest)

For European firms dealing with persistent inflation and currency volatility, Bitcoin offers an alternative store of value. Unlike fiat reserves, which can be eroded by central bank policies, Bitcoin’s supply is capped, and its monetary policy is programmed into its code. This makes it a compelling treasury asset for companies seeking to preserve long-term purchasing power.

Bitcoin’s Fourth Halving and Supply Constraints

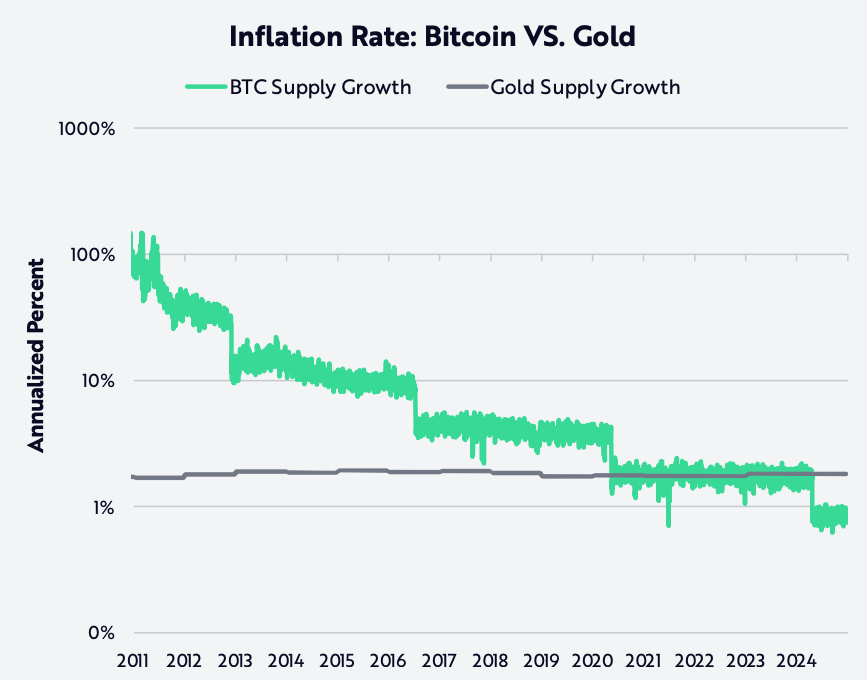

In 2024, Bitcoin underwent its fourth halving, reducing its inflation rate below gold’s long-term supply growth. With a predictable issuance schedule and increasing institutional demand, Bitcoin’s supply dynamics are unique in global finance.

(source: ARK Invest)

For corporations, this means that acquiring Bitcoin early could be a strategic move before future supply shocks drive prices higher. Whether used as a reserve asset or collateral for financing, Bitcoin’s scarcity plays to its advantage in long-term corporate financial planning.

The Growing Role of Bitcoin in Financial Services

Beyond being a store of value, Bitcoin is increasingly being integrated into financial services. The rise of Layer 2 solutions, the Lightning Network, and Bitcoin-backed financial products have made Bitcoin more usable for payments, lending, and settlements. Companies integrating Bitcoin into their payment systems can reduce transaction costs, enhance cross-border payment efficiency, and tap into a global customer base that prefers digital assets over traditional banking.

Strategic Implications for European Businesses

- Diversification & Risk Management: Bitcoin provides a hedge against fiat currency volatility, particularly in the context of monetary policy uncertainty in the Eurozone.

- Enhanced Treasury Management: Holding Bitcoin as part of a corporate treasury strategy can protect purchasing power and improve long-term asset appreciation.

- Financial Innovation & Competitive Advantage: Early adoption of Bitcoin-based payment solutions can lower costs and improve financial efficiency, positioning companies as forward-thinking industry leaders.

- Institutional Confidence & Market Maturity: With regulatory advancements and the success of ETFs, Bitcoin is no longer a fringe asset but a mainstream financial instrument.

Final Thoughts

European executives must recognize that Bitcoin is not just a passing trend—it is an emerging financial standard. With increasing adoption, favourable supply dynamics, and growing regulatory clarity, ignoring Bitcoin could mean missing out on a major financial evolution. Now is the time to explore how Bitcoin can be integrated into corporate strategies to secure long-term financial stability and competitive advantage.

The question is no longer whether Bitcoin has a role in corporate finance—but rather how soon your company will embrace it.

BTC Prague is Europe’s biggest and most influential Bitcoin event, which brings together thousands of enthusiasts, experts, and professionals. This year, the conference will devote specific attention to the paradigm shift caused by institutional Bitcoin adoption during the Industry Day.